Shooting Star Candlestick A Trader’s Guide to Potential Reversal Signals

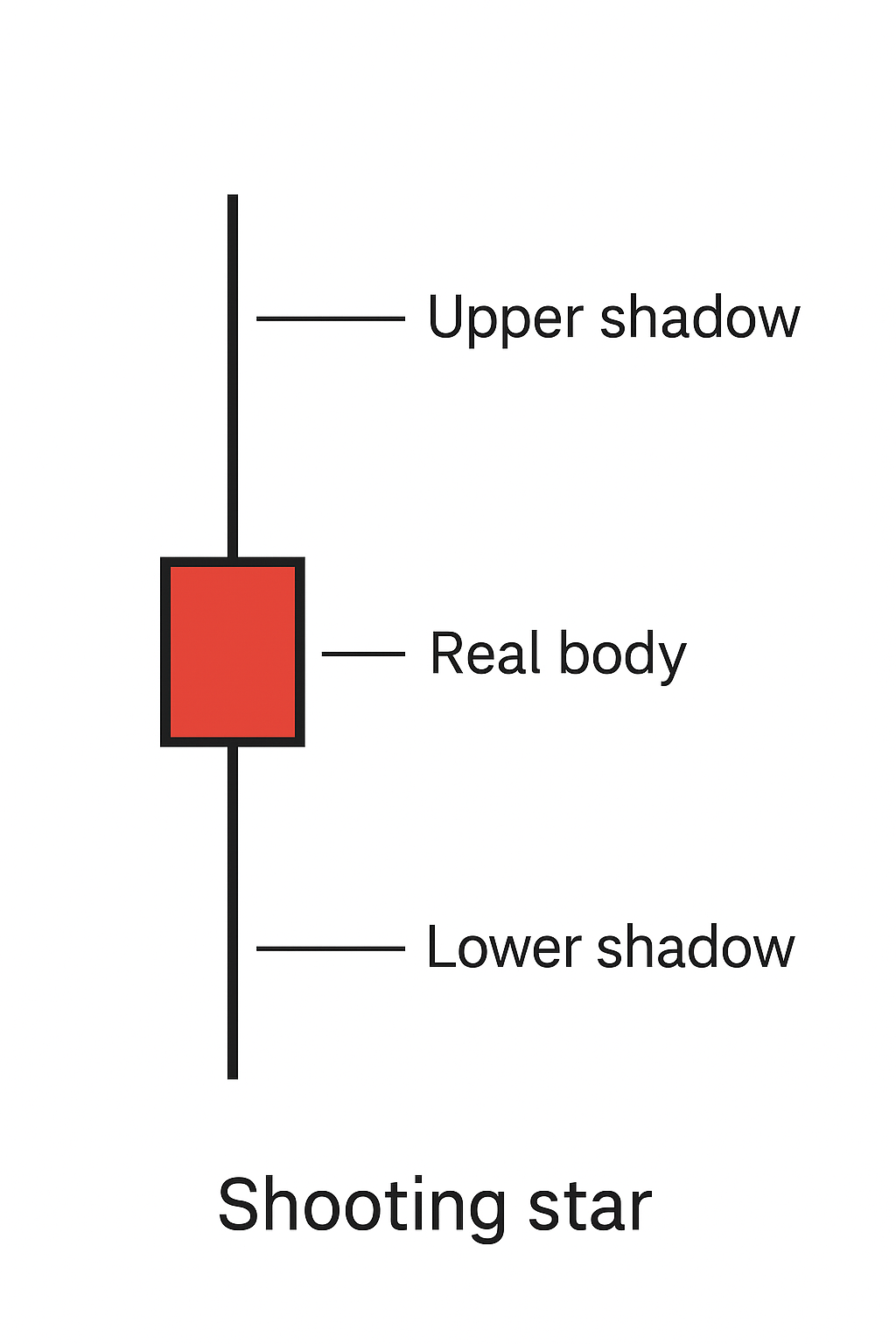

The Shooting Star candlestick is a single-bar price pattern renowned in technical analysis for signaling potential exhaustion in an uptrend and the possibility of a bearish reversal. Visually distinct, it is characterized by a small real body near the lower end of the candle’s range, a long upper wick (at least twice the length of the body), and little to no lower wick. This formation develops when a security’s price rallies significantly during the candle’s session but faces intense selling pressure that forces it to close near its opening level, leaving a “star” that appears to be falling from the sky. While its reputation as a bearish reversal signal is well-established, its true value for disciplined traders lies not in acting on the pattern alone, but in understanding the market mechanics it represents and rigorously confirming it within a broader technical context. This educational article from MEXQuick Academy will deconstruct the shooting star candlestick pattern, exploring its structure, the underlying psychology, critical confirmation requirements, and how it is interpreted across different asset classes. Our focus is solely on providing a data-driven educational framework, not on offering financial advice or profit guarantees.

What Is a Shooting Star Candlestick Pattern?

A Shooting Star candlestick is a bearish reversal candlestick pattern that forms at the peak of an uptrend. It belongs to a family of candlestick patterns that indicate rejection and potential trend change. The core narrative of the Shooting Star is one of failed bullish momentum. During the session, buyers initially push prices markedly higher, creating the long upper wick. However, by the session’s close, sellers have overwhelmed the buyers, driving the price back down to near the session’s open. This creates a small body at the lower end of the trading range, signaling that the prior bullish enthusiasm was ultimately rejected. Binary Options

The pattern’s significance is almost entirely derived from its context. A shooting star after uptrend signal carries weight because it occurs at a point where the prevailing bullish sentiment is potentially overextended. It visually represents a battle between bulls and bears where the bears have gained the upper hand by the close, suggesting that the buying power that fueled the prior advance may be exhausted. For analysts, it is a compelling clue, a warning sign of potential weakness that warrants closer attention to other confirming indicators. It is crucial to remember that as a single-bar pattern, it is an indicator of potential, not a guaranteed reversal, a concept central to disciplined, data-driven trading.

How to Identify a Shooting Star Candlestick

Correctly identifying a Shooting Star candlestick is the first step toward its effective application. A misidentified pattern can lead to false interpretations and poor trading decisions. The identification process involves checking three specific visual and structural criteria, with context being the fourth and equally critical component.

-

A Pronounced Uptrend: The pattern must occur during a defined uptrend. A similar-looking candle in a downtrend or a sideways market is not a true Shooting Star and carries different implications. The preceding price action should show a clear and sustained move higher.

-

A Small Real Body at the Lower End: The candle should have a small real body (the range between the open and close). The color of the body (red/black for a down close or green/white for an up close) is of secondary importance, though a bearish (down) close can be seen as slightly more indicative of seller strength. The key is that the body is situated at the lower end of the candle’s total range. MEXQuick Blogs

-

A Long Upper Wick: The upper wick (or shadow) must be at least twice the length of the real body. A longer wick indicates a stronger level of rejection from the session’s highs. This is the most defining visual feature of the pattern.

-

Little to No Lower Wick: A classic, textbook Shooting Star candlestick has a very small or non-existent lower wick. The ideal form shows that the session’s low was virtually at the close, with no significant rebound from the lows after the sell-off.

When learning how to identify shooting star candlestick patterns, traders often use the “wick-to-body ratio” as a quantitative filter. A ratio of 2:1 or higher (upper wick length : body length) is the minimum standard, with 3:1 being a much stronger signal. This objective measure helps filter out ambiguous candles and reinforces a disciplined, rule-based approach to pattern recognition.

The Psychology Behind the Pattern Buyer Exhaustion and Seller Rejection

The formation of a Shooting Star candlestick tells a clear story about the shift in market sentiment during a single trading period. Understanding this narrative is what separates a proficient analyst from someone who merely memorizes shapes. The pattern is a vivid illustration of uptrend exhaustion and subsequent rejection.

The session begins, often with continued bullish optimism. Buyers, confident from the prior trend, enter the market and aggressively bid the price up. This creates the long upper wick as the price makes a new high for the move. However, at these elevated levels, one of two things typically occurs, both leading to the same outcome.

First, sellers (who may be earlier buyers taking profits or new short-sellers entering) see the inflated price as an attractive opportunity. They begin to absorb supply at highs, overwhelming the incoming buy orders. Second, new buyers become scarce; the rally has exhausted the available demand at that price level. This creates a liquidity grab and fade scenario, where the market “grabs” liquidity above the prior high before reversing direction.

The resulting sell-off pushes the price back down to its opening levels or lower. The small body near the low signifies that the sellers were in complete control by the session’s end. The long upper wick is the visual evidence of this failed rally and the bearish rejection that followed. For the astute trader, this is a clear signal that the balance of power may be shifting from buyers to sellers, making further upside progress less likely.

Shooting Star vs Inverted Hammer, Evening Star, and Gravestone Doji

Distinguishing between similar candlestick patterns is essential for accurate analysis. Confusion often arises between the Shooting Star vs Inverted Hammer and the Shooting Star vs Gravestone Doji.

-

Shooting Star vs Inverted Hammer: These two patterns are visually identical. The critical difference lies entirely in their context. A Shooting Star forms at the top of an uptrend and is bearish. An Inverted Hammer forms at the bottom of a downtrend and is a bullish reversal pattern. It suggests that buyers are testing resistance, even if the close is still near the open. The market’s preceding trend is the only differentiating factor.

-

Shooting Star vs Gravestone Doji: A Gravestone Doji is a more extreme version of a Shooting Star. It has a long upper wick and no lower wick, but its open and close are at the same price, resulting in a cross-shaped pattern with no real body. The Gravestone Doji represents an even more decisive rejection, as the session closed exactly where it opened, completely erasing the intra-session gains. The Shooting Star candlestick, with its small body, is a strong signal, but the Gravestone Doji can be interpreted as an even stronger one due to the complete lack of a body.

-

Shooting Star vs Evening Star: This is a comparison of a single-candle pattern versus a three-candle pattern. The Shooting Star is a single bar. The Evening Star is a major bearish reversal pattern consisting of three candles: a long bullish candle, a small-bodied candle (which can be a Doji or a Shooting Star) that gaps above the first, and a third long bearish candle that closes well into the body of the first. The Evening Star is considered a more robust and reliable signal because it shows a clear progression: strong uptrend, indecision, and then strong confirmation of a reversal.

Confirmation Rules Volume, Next Candle, RSI, and Key Levels

A standalone Shooting Star candlestick is merely a warning. Acting on it requires shooting star candlestick confirmation. Disciplined traders wait for additional evidence that sellers are indeed taking control, which significantly improves the pattern’s accuracy and helps avoid false signals.

-

Bearish Confirmation Candle: The most direct form of confirmation is a subsequent bearish candle that closes below the real body of the Shooting Star. This “follow-through” demonstrates that selling pressure has continued beyond the initial rejection seen in the Shooting Star itself. Waiting for this next candle close is a fundamental rule for many price-action traders.

-

Volume Analysis: A shooting star with volume spike on the formation day provides strong validation. High volume indicates that the rejection was a significant event participated in by many market players. It shows conviction behind the selling pressure. Conversely, a Shooting Star on low volume may be less meaningful, as it could represent a minor pullback without broad market participation.

-

Momentum Divergence: Using an oscillator like the Relative Strength Index (RSI) can add a powerful layer of confirmation. If a shooting star RSI divergence occurs—where the price makes a new high but the RSI makes a lower high—it indicates underlying weakness in the bullish momentum. This divergence, combined with the Shooting Star’s rejection, creates a high-probability scenario for a reversal.

-

Rejection at a Key Level: The pattern’s significance is magnified when it forms at a recognized technical level. A shooting star at resistance level, a key Fibonacci retracement level (e.g., 61.8% or 78.6%), a psychological price point, or a supply zone identified through order flow or market structure analysis, is far more potent. It shows the price was rejected not just randomly, but at a point where sellers were historically anticipated.

Strategy Framework Entry, Stop-Loss, and Risk-to-Reward Planning

Integrating the Shooting Star candlestick into a systematic trading plan requires clear rules for shooting star entry and stop loss and a focus on risk management. A shooting star strategy is not about prediction; it’s about reaction and risk control. You can try download Best Stock Trading Apps in the UK

-

Entry Trigger: A conservative and common entry method is to place a sell order (or short order) after the confirmation candle closes below the Shooting Star’s body. Some traders may choose to enter on a break below the low of the Shooting Star itself. The key is to have a predefined trigger that moves beyond the pattern’s formation.

-

Stop-Loss Placement: The logical level for a shooting star risk management stop-loss is placed above the high of the Shooting Star’s long upper wick. This level represents the point of rejection; if the price moves above it, the bearish signal is invalidated, as it indicates the sellers who created the pattern have been overwhelmed. Using a trailing stop above wick is a sound practice.

-

Profit Targets and Risk-to-Reward Ratio: Targets should be based on objective technical levels. These could be the next level of support, a key moving average, or a measured move based on the preceding trend. Before entering any trade, a trader must calculate the risk-reward ratio. The distance from the entry point to the stop-loss defines the risk (R). The distance from the entry to the profit target should represent a potential reward of at least 1.5R or 2R to justify the trade. Proper position sizing is then used to ensure the total risk per trade aligns with the trader’s overall capital management rules.

Common Mistakes and False Signals

Even with a well-defined pattern, traders can fall prey to common errors when dealing with a Shooting Star candlestick.

-

Trading Without Confirmation: The most frequent mistake is acting on the pattern immediately as it forms, before the close of the confirmation candle. This often leads to entering a trade only to see the price reverse back up, resulting in a losing position.

-

Ignoring the Trend Context: Attempting to identify a Shooting Star in a downtrend or a choppy, range-bound market is a fundamental error. The pattern loses its meaning outside of a clear uptrend.

-

Misinterpreting a False Breakout: Sometimes, a long upper wick can represent a false breakout wick that traps late buyers before a reversal. However, without confirmation, it’s impossible to know if it’s a true reversal or just a brief pause. Disciplined traders wait for the market to show its hand.

-

Neglecting Volume: Overlooking volume can lead to taking signals from insignificant price moves. A high-volume rejection is a statement; a low-volume one is a whisper.

-

Poor Risk-Reward Setup: Entering a trade where the stop-loss is disproportionately large compared to the realistic profit target is a strategic error, even if the pattern itself is technically valid.

Multi-Timeframe Confluence and Institutional Context

Professional traders rarely rely on a single timeframe. They seek multi-timeframe confluence to strengthen the validity of a setup. A Shooting Star candlestick on a 1-hour chart is far more compelling if it also aligns with resistance on the 4-hour chart and occurs while the daily chart’s RSI is in overbought territory.

For instance, a trader might use a higher timeframe (e.g., Daily) to identify the primary trend and key resistance levels. Then, a middle timeframe (e.g., 4-Hour) can be used to identify the shooting star after uptrend signal. Finally, a lower timeframe (e.g., 1-Hour) can be used for precise entry below low of the confirmation candle. This layered approach ensures the trade idea is aligned with the broader market structure.

Furthermore, understanding the potential institutional context is valuable. The long wick of the Shooting Star can often be linked to order flow clues. It may represent a liquidity pool being taken out above a prior high, triggering buy-stops before a sharp reversal. This “stop-hunt” or liquidity grab and fade is a common theme in modern markets, and the Shooting Star is one of its clearest visual manifestations.

Examples in Crypto, Forex, and Stock Charts

The Shooting Star candlestick is a universal pattern, but its interpretation can have slight nuances across different markets.

-

Shooting Star Candlestick Forex: In the highly liquid forex market, a Shooting Star is particularly significant when it forms on major currency pairs (like EUR/USD or GBP/USD) around key psychological levels (e.g., 1.10000) or major technical resistance. Confirmation with volume (using tick volume as a proxy) and momentum divergence is key. A shooting star candlestick forex example might show a pattern forming after a sustained rally, right at a key fibonacci retracement level, leading to a significant pullback.

-

Shooting Star Candlestick Crypto: The crypto market’s inherent volatility can produce many long-wicked candles. Therefore, shooting star candlestick confirmation is even more critical. A shooting star candlestick crypto example on a Bitcoin chart might be very pronounced, with a wick that is many times the body’s length, often representing a violent rejection after a rapid, FOMO-driven pump. The pattern’s reliability increases when it forms at a known historical resistance level.

-

Shooting Star Candlestick Stocks: In the stock market, the pattern is effective on both daily and intraday timeframes. A shooting star candlestick stocks example could be a stock gapping up on earnings, rallying further intraday, but then closing near its open, forming a Shooting Star. This can indicate that the positive news MEXQuick was already “priced in,” and selling pressure emerged. For shooting star day trading, the pattern can be effective on 5-minute or 15-minute charts, especially when it forms after a sharp uptrend and at a VWAP rejection or a moving average resistance.

MEXQuick’s Educational Approach to Price-Action Discipline

At MEXQuick, our mission is to empower traders with knowledge, not to provide speculative signals. The study of patterns like the Shooting Star candlestick is not about finding a “holy grail” but about understanding the probabilistic nature of markets. A disciplined, data-driven trader views this pattern as one piece of a larger puzzle.

Our educational philosophy emphasizes:

-

Context is King: No pattern exists in a vacuum. The trend, key levels, and market environment are paramount.

-

Confirmation is Mandatory: We teach the necessity of waiting for follow-through price action and confluence from other non-correlated indicators.

-

Risk Management is Non-Negotiable: Every trade plan must define risk before reward, with precise stop-loss and position sizing rules.

-

Continuous Learning: Markets evolve. We encourage backtesting and forward testing strategies to understand their historical performance and current applicability.

The Shooting Star candlestick accuracy rate is not a fixed number; it is a variable that depends entirely on the skill of the analyst in applying the rules of context and confirmation. By focusing on the underlying principles of demand/supply mapping and rejection, traders can move beyond simply recognizing a candle shape to interpreting the market dynamics it represents.

Conclusion

The Shooting Star candlestick is a powerful and visually intuitive pattern that signals potential bearish reversals following an uptrend. Its structure—a small body near the lows, a long upper wick, and no lower wick—tells a clear story of buyer exhaustion and seller rejection at key levels. However, its true utility for the disciplined trader lies not in the pattern itself, but in the rigorous process of confirmation that follows. By integrating follow-through price action, volume analysis, momentum divergence, and key level analysis, traders can transform a potential warning signal into a structured, rule-based trading hypothesis with clearly defined risk.

Ultimately, successful technical analysis is a function of consistency, patience, and robust risk management. The Shooting Star candlestick, like all technical tools, is a component of a broader system, not a standalone solution. At MEXQuick, we believe that fostering a deep understanding of these concepts—the “why” behind the “what”—is the foundation of informed and responsible market participation.